State Income Taxes

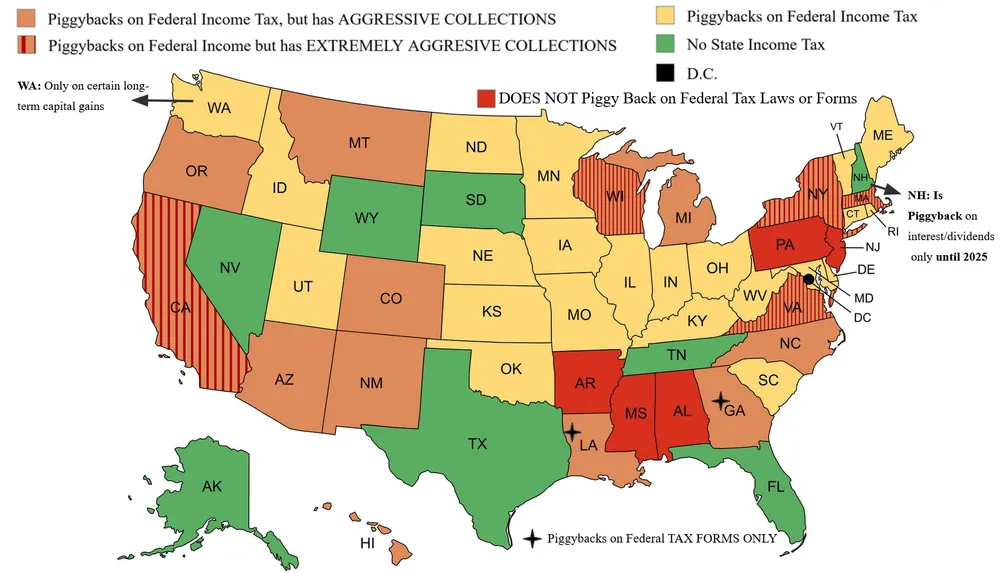

Many states tie their income tax laws to federal income tax laws by adopting Internal Revenue Code definitions, calculating state tax as a percentage of federal taxes owed, or using other methods. This practice, referred to as “piggy-backing” by Freedom Law School, means most residents in these states may not owe additional state income taxes. Please refer to the map and information below.

While our Restore Freedom Plan and Employer Freedom Plan do not cover state tax collections, our staff is available to assist students in responding to unwarranted collection attempts by state taxation agencies.

No income tax at all

You don’t need to do anything! These states don’t have any income tax.

- Alaska

- Florida

- Nevada

- New Hampshire (Beginning January 1, 2025)

- South Dakota

- Tennessee

- Texas

- Washington (Except certain long-term capital gain starting in 2022)

- Wyoming

Based on the federal laws

These states’ have an income tax which laws are based on the federal income tax laws.

State tax agency is known to be aggressive with collections +

State tax agency is known to be very aggressive with collections ++

- Arizona +

- California ++

- Colorado +

- Connecticut

- Delaware

- Georgia + (Tax forms only. Laws do not piggy-back)

- Hawaii +

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana + (Tax forms only. Laws do not piggy-back)

- Maine

- Maryland

- Massachusetts ++

- Michigan +

- Minnesota

- Montana +

- New Hampshire (Will become a no income tax state after December 31, 2024. Currently only liable for taxes on interest and dividends. Piggy-backs on tax forms only; the laws do not appear to piggy-back)

- Nebraska

- New Mexico +

- New York ++

- North Carolina +

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Rhode Island

- South Carolina

- Utah

- Vermont

- Virginia ++

- West Virginia

- Wisconsin ++

Independent from federal laws

These states’ income tax laws are independent from federal laws, and you cannot exempt from them.

- Alabama

- Arkansas

- Mississippi

- New Jersey

- Pennsylvania

If you have additional questions or concerns, call our office and ask directly by calling (813) 444-4800.